maston

October 6, 2024 Home Loans

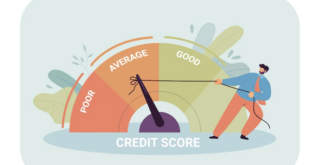

Home Loan with Bad Credit: How to Secure Financing Even with Low Credit Scores. Getting a home loan with bad credit can seem daunting, but it’s far from impossible. Many people assume that a low credit score will automatically disqualify them from buying a house, but that’s not always the case. With careful planning, persistence, and knowledge of the right strategies, …

Read More »

maston

October 6, 2024 Home Loans

Mortgage Down Payment Assistance: A Guide. Homeownership is a dream for many, but the biggest hurdle often lies in saving enough for a down payment. Mortgage down payment assistance can be a lifeline for first-time buyers or those struggling to afford the upfront costs. This guide will explain what down payment assistance is, who qualifies for it, and how you can …

Read More »

maston

October 6, 2024 Home Loans

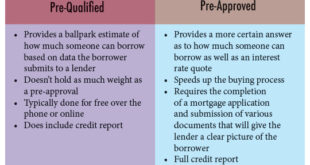

Mortgage Prequalification vs Preapproval: Understanding the Importance. When you’re preparing to buy a home, it’s important to understand the key differences between mortgage prequalification and mortgage preapproval. Both terms are essential steps in the homebuying process, but they serve different purposes and offer varying levels of certainty to buyers and sellers. In this article, we will explore the details of mortgage …

Read More »

maston

October 6, 2024 Home Loans

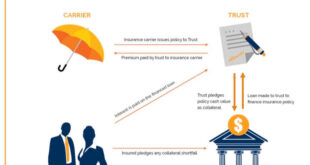

Mortgage Insurance Premium: Its Importance and How It Works. When considering a mortgage, many buyers are often surprised by additional costs that are not part of the principal and interest. One such cost is the Mortgage Insurance Premium (MIP). Understanding what a mortgage insurance premium is, how it works, and why it’s necessary can help homeowners make more informed decisions. …

Read More »

maston

October 6, 2024 Home Loans

Mortgage Points Explained: How They Work and How to Use Them Wisely. When considering buying a home, or even refinancing, understanding the concept of mortgage points can significantly affect how much you end up paying over time. Mortgage points, also known as discount points, allow you to lower your mortgage interest rate, resulting in long-term savings. But are they always worth …

Read More »

maston

October 5, 2024 Home Loans

No Credit Home Loans: A Guide to Securing Your Dream Home. In today’s financial landscape, obtaining a home loan can be challenging, especially for individuals with no credit history or poor credit scores. However, the emergence of no credit home loans offers a viable solution for many aspiring homeowners. This article will delve into what no credit home loans are, …

Read More »

maston

October 5, 2024 Home Loans

Home Loan Closing Costs: Everything You Need to Know. When purchasing a home, the home loan closing process can be both exciting and overwhelming. One of the essential parts of this process is the closing costs, which are fees and expenses you need to pay in addition to your home loan. Whether you are a first-time buyer or refinancing your mortgage, …

Read More »

maston

October 5, 2024 Home Loans

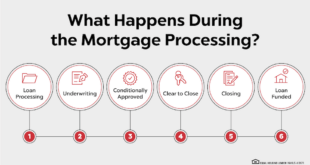

How to Qualify for a Mortgage: Your Guide to Homeownership. Qualifying for a mortgage is a crucial step in your journey toward homeownership. Whether you’re a first-time buyer or looking to refinance, understanding the requirements and process can make a significant difference. In this article, we’ll cover everything you need to know about how to qualify for a mortgage, from credit …

Read More »

maston

October 5, 2024 Home Loans

Home Loan Interest Rates: Understanding, Impact, and Trends. When considering a home loan, one of the most crucial factors that influence your borrowing costs is the interest rate. Home loan interest rates can vary significantly based on a multitude of factors, including economic conditions, your credit score, and the type of mortgage you choose. Understanding these rates is essential for …

Read More »

maston

October 5, 2024 Home Loans

Refinancing Home Loans: A Guide to Saving Money. Refinancing home loans can be a strategic financial decision for homeowners looking to optimize their mortgage terms, lower monthly payments, or access home equity. In this article, we will explore the ins and outs of refinancing, including the benefits, the process, and crucial tips for making informed decisions. Understanding Refinancing Home Loans Refinancing …

Read More »

maston

October 5, 2024 Home Loans

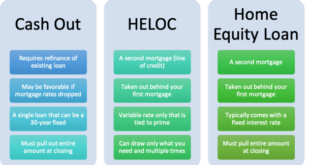

Home Equity Loan vs. Mortgage: Understanding Choosing the Right Option. In the world of financing, understanding the various options available can be a daunting task. Two common financing options that often come up for homeowners are home equity loans and mortgages. Both are tied to real estate and can provide necessary funding, but they serve different purposes and have distinct features. …

Read More »

maston

October 5, 2024 Home Loans

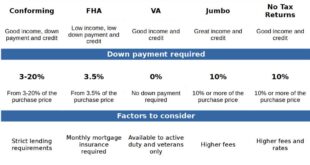

Conventional Home Loans: Everything You Need to Know. When it comes to purchasing a home, one of the most common financing options is a conventional home loan. But what exactly is it, and how does it differ from other loan types? This article will provide an in-depth explanation of conventional home loans, covering everything from their requirements and benefits to the …

Read More »

maston

October 5, 2024 Home Loans

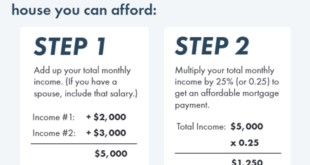

Low Down Payment Home Loans: A Comprehensive Guide. In today’s housing market, the cost of purchasing a home can be overwhelming, especially when it comes to the upfront down payment. Many potential buyers are unaware that there are several low down payment home loan options available. These types of loans make it easier for first-time homebuyers or those with limited savings …

Read More »

maston

October 5, 2024 Home Loans

USDA Home Loans: The Guide for First-Time Homebuyers. USDA home loans are a popular financing option for homebuyers in rural areas who want to purchase a home with little to no down payment. These loans, backed by the U.S. Department of Agriculture, provide an affordable pathway to homeownership for low-to-moderate-income families. In this article, we’ll explore everything you need to know …

Read More »

maston

October 5, 2024 Home Loans

Jumbo Home Loans: A Complete Guide for Homebuyers in 2024. Jumbo home loans are a popular option for people looking to purchase high-value properties, especially in areas where home prices exceed the limits set by conventional loans. If you’re in the market for a more expensive home, a jumbo loan might be your best financing option. But what exactly are jumbo …

Read More »

Gerbang Finance

Gerbang Finance