maston

October 6, 2024 Home Loans

VA Home Loan Benefits: Unlocking the Door to Homeownership for Veterans. For many veterans and active-duty military personnel, homeownership is not just a dream; it’s a well-deserved reality. The VA home loan program, established by the U.S. Department of Veterans Affairs (VA), offers unique benefits that make purchasing a home more accessible and affordable. This article will explore the various advantages …

Read More »

maston

October 6, 2024 Home Loans

FHA vs. Conventional Home Loans: Understanding Your Options for Home Financing. When it comes to buying a home, securing the right financing is crucial. Among the most popular choices are FHA (Federal Housing Administration) loans and conventional home loans. Each option has its unique features, benefits, and drawbacks, making it essential to understand how they differ. In this comprehensive article, we …

Read More »

maston

October 6, 2024 Home Loans

Mortgage Rates Forecast: What You Need to Know in 2024. As we step into 2024, the landscape of mortgage rates is poised for significant changes. For potential homebuyers and homeowners looking to refinance, understanding the forecast for mortgage rates is crucial for making informed financial decisions. This article will delve into the factors influencing mortgage rates, predictions for 2024, and …

Read More »

maston

October 6, 2024 Home Loans

How to Pay Off Mortgage Early: 10 Tips to Save Time and Money. Paying off a mortgage early is a goal for many homeowners. It not only helps save on interest payments but also provides peace of mind and financial freedom. While paying off your mortgage faster might seem challenging, there are several strategies to help you achieve this goal more …

Read More »

maston

October 6, 2024 Home Loans

Best Mortgage Lenders in USA: Top Picks for 2024. When it comes to buying a home, choosing the right mortgage lender is one of the most critical decisions you’ll make. Finding a lender that offers competitive rates, exceptional service, and favorable terms can save you thousands over the life of your loan. Whether you’re a first-time homebuyer or looking to refinance, …

Read More »

maston

October 6, 2024 Home Loans

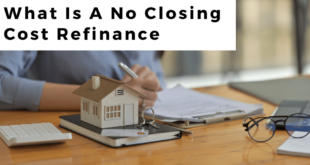

Mortgage with No Closing Costs: A Comprehensive Guide. If you’re considering buying a home or refinancing your current mortgage, you’ve probably come across the term “mortgage with no closing costs.” While the idea of eliminating upfront fees sounds appealing, it’s important to understand how these mortgages work, their advantages, disadvantages, and whether they are the right choice for you. What is …

Read More »

maston

October 6, 2024 Home Loans

How to Refinance a Mortgage: A Guide. Refinancing a mortgage can be an effective strategy for homeowners looking to lower their interest rates, reduce monthly payments, or pay off their home loans faster. However, the process can seem overwhelming if you don’t know where to start. In this guide, we’ll break down everything you need to know about how to refinance …

Read More »

maston

October 6, 2024 Home Loans

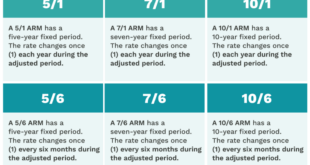

Fixed vs Adjustable-Rate Mortgages: Which is Right for You?. When deciding on a mortgage for your home, one of the most critical choices you’ll face is choosing between a fixed-rate and an adjustable-rate mortgage (ARM). Both options come with their own benefits and risks, and the right choice depends largely on your financial situation and long-term goals. In this article, we’ll …

Read More »

maston

October 6, 2024 Home Loans

Home Loan Approval Timeline: A Step-by-Step Guide. When considering buying a home, one of the most important steps is securing a mortgage, commonly known as a home loan. The home loan approval timeline can vary significantly based on several factors, from the lender’s process to your personal financial situation. Understanding this timeline will help you prepare better and manage your expectations. …

Read More »

maston

October 6, 2024 Home Loans

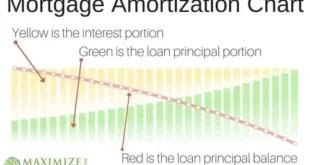

Home Loan Amortization: Understanding How Its Impact on Your Finances. When it comes to financing a home, one of the most important concepts to understand is home loan amortization. This term often confuses first-time homebuyers, but mastering the basics can help you make more informed decisions about your mortgage, potentially saving you thousands of dollars over the life of your loan. …

Read More »

maston

October 6, 2024 Personal Loans

Reverse Mortgages Explained: A Guide for Homeowners. In today’s financial landscape, reverse mortgages have become a popular option for homeowners, especially those nearing or in retirement. They offer a way to unlock the value of your home without selling it, providing much-needed funds for everyday expenses, medical costs, or other financial goals. In this article, we’ll dive deep into reverse mortgages, …

Read More »

maston

October 6, 2024 Personal Loans

Mortgage for Vacation Homes: A Guide to Financing Your Dream Getaway. Purchasing a vacation home is a dream for many, offering a place to escape from daily stress or an opportunity to earn passive income through short-term rentals. If you’re considering buying a vacation property, understanding the mortgage process is key to ensuring a smooth purchase. This guide will walk you …

Read More »

maston

October 6, 2024 Home Loans

Home Loan Without a Job: How to Secure Financing in Tough Times. Getting a home loan without a traditional job can seem impossible, but it’s not. Many individuals find themselves in situations where they are not employed full-time or have recently become unemployed. Whether you’re a freelancer, contractor, or entrepreneur, obtaining a home loan without a job is possible if …

Read More »

maston

October 6, 2024 Home Loans

Investment Property Loans: A Guide for Smart Investors. Investment property loans are a crucial aspect of real estate investing. They offer the financial leverage that investors need to purchase properties, whether for residential rentals or commercial purposes. However, these loans come with unique requirements and challenges that set them apart from typical home loans. In this guide, we’ll explore everything you …

Read More »

maston

October 6, 2024 Home Loans

Home Loan for Self-Employed: A Guide to Securing a Mortgage. Securing a home loan can be challenging for anyone, but it is often even more complex for self-employed individuals. Without the traditional forms of income verification that salaried workers can present, lenders may require more documentation and stricter qualifications from self-employed borrowers. This article will explore the process of obtaining a …

Read More »

Gerbang Finance

Gerbang Finance