Jenifer Arley

October 7, 2024 Credit Card

Authorized User on Credit Cards: Maximizing Benefits In today’s credit-driven world, understanding the nuances of credit cards is essential. One often-overlooked feature is the concept of an authorized user. This guide will delve into what it means to be an authorized user on credit cards, the benefits and drawbacks, how to become one, and how this status can impact your …

Read More »

Jenifer Arley

October 7, 2024 Credit Card

Mobile Payment Credit Cards: Seamless Transactions In the age of smartphones and digital solutions, convenience is king. One of the most significant innovations in this landscape is the mobile payment credit card. This technology allows users to make purchases using their smartphones or smartwatches, eliminating the need for physical cards. If you’re new to mobile payments or looking to explore …

Read More »

Jenifer Arley

October 7, 2024 Credit Card

Contactless Credit Cards: Revolutionizing Modern Payments In today’s fast-paced digital world, convenience and security have become critical factors when choosing payment methods. One innovation that addresses both is the contactless credit card. As consumers seek faster, safer, and more efficient ways to make transactions, contactless technology is rapidly gaining popularity. This article explores everything you need to know about contactless …

Read More »

Jenifer Arley

October 7, 2024 Credit Card

Credit Card Debt Management: Financial Freedom Credit card debt can be a heavy burden, impacting not only your finances but also your mental well-being. However, with the right approach and consistent effort, managing credit card debt is possible. This article provides comprehensive strategies for credit card debt management, helping you regain control of your finances and achieve long-term financial freedom. …

Read More »

Jenifer Arley

October 7, 2024 Credit Card

Foreign Transaction Fee Credit Cards: Everything You Need to Know Foreign transaction fees can be a hidden cost that catches travelers off guard when using credit cards abroad. Whether you’re a frequent traveler or planning an international trip, understanding how foreign transaction fee credit cards work is essential. This article delves into foreign transaction fees, what to look for in …

Read More »

Jenifer Arley

October 7, 2024 Credit Card

Credit Card Rewards Programs: Best Benefits for Your Spending Credit card rewards programs are one of the most popular incentives that banks and financial institutions offer to attract consumers. These programs allow cardholders to earn rewards—ranging from cashback, travel points, discounts, or even exclusive deals—every time they make a purchase. However, to maximize the benefits of these programs, it’s essential …

Read More »

Jenifer Arley

October 7, 2024 Credit Card

How to Build Credit with a Credit Card: A Step-by-Step Guide Building credit is essential for financial stability and access to various financial products like loans, mortgages, or better insurance rates. A credit card is one of the most effective tools for building and improving your credit score, but it must be used responsibly. In this article, we’ll explore how …

Read More »

maston

October 6, 2024 Home Loans

Home Loan Approval Checklist: Your Guide to Securing Your Mortgage. In today’s competitive housing market, securing a home loan can be both an exciting and daunting task. To simplify the process, we’ve created a comprehensive home loan approval checklist to guide you through the necessary steps and requirements. This article will delve into the essential components of the home loan approval …

Read More »

maston

October 6, 2024 Home Loans

30-Year Fixed Mortgage vs. 15-Year: Which Is Right for You? When considering a home loan, one of the most significant decisions decisions you’ll make is choosing between a 30-year fixed mortgage and a 15-year fixed mortgage. Both options have distinct advantages and disadvantages that can impact your financial future. Understanding these differences can help you make an informed decision that aligns …

Read More »

maston

October 6, 2024 Home Loans

Home Loan for Teachers: A Guide to Financing Your Dream Home. In today’s economic landscape, securing a home loan is crucial for many individuals, including teachers. With a stable job and a passion for education, teachers are often in a prime position to obtain favorable mortgage terms. This article will explore everything you need to know about home loans tailored for …

Read More »

maston

October 6, 2024 Home Loans

Mortgage for Second Homes: A Comprehensive Guide. Purchasing a second home can be a rewarding investment, whether for vacation, rental income, or future retirement. However, securing a mortgage for a second home comes with its unique set of challenges and considerations. This guide explores the ins and outs of obtaining a mortgage for a second property, providing you with valuable insights …

Read More »

maston

October 6, 2024 Home Loans

Government Home Loan Programs: Your Pathway to Affordable Housing. Navigating the world of homeownership can often feel overwhelming, especially with the myriad of options available. However, government home loan programs serve as a beacon of hope for many potential homeowners. These initiatives, designed to make housing more accessible, provide favorable terms and conditions to help individuals and families secure their …

Read More »

maston

October 6, 2024 Home Loans

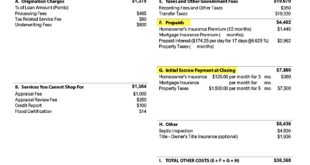

Mortgage Loan Fees Breakdown: Understanding the Costs Involved in Your Home Loan. When considering a mortgage loan, understanding the associated fees can be a daunting task. Many prospective homeowners focus solely on the interest rate, neglecting the various fees that can significantly impact the overall cost of borrowing. This comprehensive guide will break down mortgage loan fees, providing clarity on what …

Read More »

maston

October 6, 2024 Home Loans

Mortgage Affordability Calculator: Your Essential Tool for Home Buying. When it comes to buying a home, understanding what you can afford is crucial. A mortgage affordability calculator is an invaluable tool that helps prospective homebuyers determine their purchasing power based on their financial situation. This article will guide you through the ins and outs of mortgage affordability calculators, providing comprehensive insights, …

Read More »

maston

October 6, 2024 Home Loans

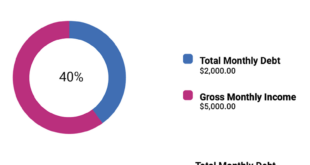

Home Loan Debt-to-Income Ratio: Understanding Its Impact on Your Mortgage Application. When it comes to securing a home loan, understanding the debt-to-income (DTI) ratio is essential. This critical financial metric helps lenders assess your ability to manage monthly payments and determines your eligibility for a mortgage. In this article, we will explore the home loan debt-to-income ratio in detail, providing insights …

Read More »

Gerbang Finance

Gerbang Finance