Jenifer Arley

November 28, 2024 Personal Loans

Investment Personal Loan: Loans for Financial Growth An investment personal loan can be a strategic financial tool to enhance your wealth-building journey. With proper planning and execution, it allows you to fund profitable ventures, diversify investments, or consolidate financial goals. However, understanding its nuances is essential to maximize benefits and avoid pitfalls. This guide will provide detailed insights into investment …

Read More »

Jenifer Arley

November 28, 2024 Personal Loans

Cash Flow Loan: Boost Your Business Finances Managing cash flow effectively is critical for any business, especially during periods of growth or financial strain. Cash flow loans are tailored to address immediate cash needs, offering businesses the flexibility to cover operational expenses or seize growth opportunities without lengthy approval processes. In this article, we’ll delve into what cash flow loans …

Read More »

Jenifer Arley

November 28, 2024 Personal Loans

Variable Rate Loan: Know Before Choosing One Variable rate loans are a popular financing option for many borrowers. They offer flexibility, potentially lower initial costs, and the chance to save as interest rates fluctuate. However, understanding the intricacies of variable rate loans is crucial to making an informed decision. In this article, we’ll delve into the details of variable rate …

Read More »

Jenifer Arley

November 27, 2024 Personal Loans

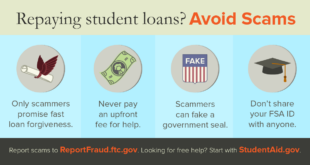

Student Loan Assistance: Navigating College Debt Relief Paying off student loans can feel overwhelming, but the right assistance can ease the burden and help you regain financial freedom. In this guide, we explore student loan assistance programs, tips, and resources designed to simplify repayment and lighten your debt load. Whether you’re just starting repayment or struggling to keep up, this …

Read More »

Jenifer Arley

November 27, 2024 Personal Loans

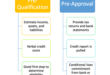

Personal Loan No Collateral: Unsecured Loans Looking for a loan but worried about pledging your assets? Personal loan no collateral could be the solution. This type of loan is ideal for individuals who need funds without risking their property or valuables. This article delves into the essentials of personal loans without collateral, from their benefits and application process to tips …

Read More »

Jenifer Arley

November 27, 2024 Personal Loans

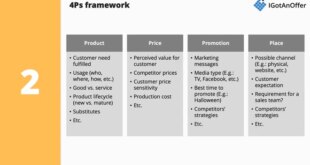

Business Expansion Loan: Unlocking Growth Opportunities for Your Company Expanding a business often requires a significant financial investment. A business expansion loan can provide the necessary funds to help your company scale operations, enter new markets, and improve infrastructure. In this comprehensive guide, we’ll explore everything you need to know about business expansion loans, from benefits to application tips. What …

Read More »

Jenifer Arley

November 27, 2024 Personal Loans

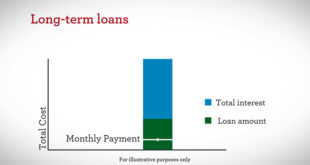

Compare Loan Terms: Best Option for Your Needs When looking for a loan, understanding and comparing loan terms is crucial. Loan terms determine how much you’ll pay over time, the flexibility of payments, and the overall cost of borrowing. This guide will walk you through what loan terms are, how to compare them effectively, and how to choose the best …

Read More »

Jenifer Arley

November 26, 2024 Personal Loans

Quick Personal Loan Approval: Tips to Get Approved Fast In today’s fast-paced world, securing financial assistance quickly can be crucial. Whether it’s for an emergency or a major purchase, understanding how to expedite the personal loan approval process is key. This article delves into strategies to achieve quick personal loan approval, highlighting essential tips, common FAQs, and a detailed conclusion …

Read More »

Jenifer Arley

November 26, 2024 Personal Loans

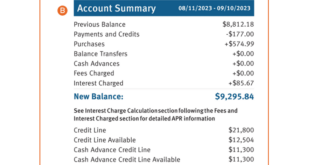

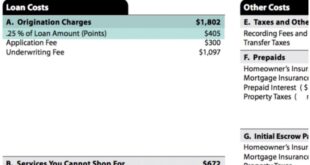

Personal Loan Fees Comparison: Finding the Best Option When exploring personal loans, understanding and comparing fees is crucial. Loan fees can significantly impact your borrowing costs, making it essential to evaluate and choose wisely. This article provides a comprehensive guide to comparing personal loan fees, ensuring you make an informed decision while adhering to SEO-friendly principles. What Are Personal Loan …

Read More »

Jenifer Arley

November 26, 2024 Personal Loans

Emergency Funds Loan: Quick Financial Relief When emergencies strike, having access to an emergency funds loan can be a lifesaver. This article delves deep into what emergency funds loans are, how they work, and tips to maximize their benefits. Whether you’re dealing with unexpected medical bills, urgent home repairs, or other unforeseen expenses, this guide will help you navigate your …

Read More »

Jenifer Arley

November 26, 2024 Personal Loans

Loan Processing Fee: Everything You Need to Know Understanding the loan processing fee is essential for anyone considering a personal loan, home loan, or business loan. This fee is one of the many charges financial institutions impose, and it can significantly affect the total cost of borrowing. This comprehensive guide will explain what a loan processing fee is, how it …

Read More »

Jenifer Arley

November 25, 2024 Personal Loans

Customizable Loan Terms: Flexible Financing Customizable loan terms provide borrowers the flexibility to tailor loans to their specific needs, offering options to adjust repayment periods, interest rates, and payment schedules. This guide dives deep into the concept, benefits, tips for customization, and frequently asked questions to help you make informed decisions about flexible financing options. What Are Customizable Loan Terms? …

Read More »

Jenifer Arley

November 25, 2024 Personal Loans

Unsecured Loan Options: Making the Right Choice When financial needs arise, and you lack collateral, unsecured loan options This guide covers everything you need to know about unsecured loans, including their types, benefits, drawbacks, and tips for making the best decision. What Are Unsecured Loans? Unsecured loans are loans that don’t require collateral, such as a car or home, to …

Read More »

Jenifer Arley

November 25, 2024 Personal Loans

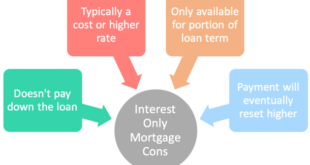

Interest-Only Loan: Everything You Need to Know An interest-only loan is a unique type of financing that allows borrowers to pay only the interest on the loan for a predetermined period, typically the first few years. These loans can be appealing for certain financial situations but come with distinct advantages and risks. Understanding the mechanics, benefits, and potential drawbacks is …

Read More »

Jenifer Arley

November 25, 2024 Personal Loans

High-Risk Loan: Basics, Benefits, and Navigate Them High-risk loans can be a viable option for individuals or businesses that may not qualify for traditional financing. However, these loans come with their own challenges, including higher interest rates and stricter repayment terms. In this comprehensive guide, we will explore everything you need to know about high-risk loans, their advantages and drawbacks, …

Read More »

Gerbang Finance

Gerbang Finance