Jenifer Arley

December 3, 2024 Personal Loans

Minimal Loan Processing: Simplify Your Loan Journey In today’s fast-paced world, borrowers often seek loans with minimal processing to avoid unnecessary delays. This article delves into how minimal loan processing works, its benefits, and how to find lenders that prioritize speed and simplicity. What Is Minimal Loan Processing? Minimal loan processing refers to loan applications streamlined to reduce paperwork and …

Read More »

Jenifer Arley

December 2, 2024 Personal Loans

Travel Expense Loan: Managing Travel Costs Traveling is an adventure, but it can also strain your finances. A travel expense loan can help you manage costs without sacrificing your dream trip. Learn how it works, its benefits, and tips for smart borrowing. What is a Travel Expense Loan? A travel expense loan is a type of personal loan designed specifically …

Read More »

Jenifer Arley

December 2, 2024 Personal Loans

Shorter Loan Tenure: Save Money and Reduce Debt Faster When it comes to loans, the term length plays a critical role in determining your financial commitments. Opting for a shorter loan tenure is a strategy that can help you save on interest and clear your debt faster. This article delves into the benefits, challenges, and essential tips for managing shorter …

Read More »

Jenifer Arley

December 2, 2024 Personal Loans

Personal Loan Policies: Loan Terms and Conditions Personal loan policies are the backbone of every successful loan agreement. Understanding these policies can save you from unexpected fees, complications, or misunderstandings down the road. This guide breaks down everything you need to know about personal loan policies, ensuring you’re well-prepared to make informed decisions. What Are Personal Loan Policies? Personal loan …

Read More »

Jenifer Arley

December 2, 2024 Personal Loans

Personal Loan Tenure: Choosing the Right Loan Term When considering a personal loan, the tenure—or repayment period—is a critical factor that impacts your monthly installments and overall financial health. Selecting the right tenure involves balancing affordable monthly payments with minimizing interest costs. This guide will help you navigate the nuances of personal loan tenures and make an informed decision. What …

Read More »

Jenifer Arley

November 30, 2024 Personal Loans

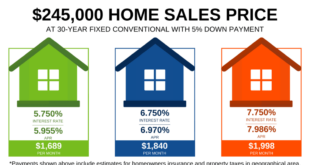

Low Fixed Rate: Affordable and Predictable Loans In today’s financial world, the term low fixed rate has gained significant importance for individuals seeking predictable and affordable loan options. Whether you’re considering a mortgage, personal loan, or auto financing, understanding low fixed rates can save you money and bring financial stability. This comprehensive guide will walk you through the benefits, considerations, …

Read More »

Jenifer Arley

November 30, 2024 Personal Loans

Monthly Loan Interest: Works and Ways to Manage It Effectively When applying for a loan, understanding the monthly loan interest is crucial. It impacts how much you pay over time and can make the difference between a manageable loan and financial stress. This guide will break down what monthly loan interest is, how it works, factors influencing it, and strategies …

Read More »

Jenifer Arley

November 30, 2024 Personal Loans

Loan Security Waiver: What It Is and Why It Matters In the financial world, securing a loan often requires providing some form of collateral to guarantee repayment. However, in certain cases, borrowers may qualify for a loan security waiver, allowing them to obtain financing without pledging assets. This article dives deep into the concept of loan security waivers, their benefits, …

Read More »

Jenifer Arley

November 30, 2024 Personal Loans

Personal Loan with Benefits: Maximizing Financial Opportunities Personal loans are a versatile financial tool, offering flexibility and ease for those seeking quick funding. However, understanding the unique benefits of personal loans can help borrowers make informed decisions and unlock opportunities. In this article, we’ll explore the advantages of personal loans, how they compare to other financing options, and tips to …

Read More »

Jenifer Arley

November 30, 2024 Personal Loans

Fixed-Term Loan: Understanding and Maximizing Its Benefits Fixed-term loans are a popular financial product that provides borrowers with a predictable repayment schedule and clear terms. Whether you’re looking to finance a large purchase, consolidate debt, or meet specific financial needs, understanding how fixed-term loans work is essential. This guide dives into their features, benefits, application process, and tips for choosing …

Read More »

Jenifer Arley

November 29, 2024 Personal Loans

Special Loan Rate: Best Deals and Maximizing Savings Understanding and utilizing special loan rates can save you significant money and make your financial goals achievable. Whether you’re planning a home renovation, consolidating debt, or pursuing higher education, finding a special loan rate tailored to your needs is crucial. This comprehensive guide covers everything you need to know about special loan …

Read More »

Jenifer Arley

November 29, 2024 Personal Loans

Refinancing Personal Loan: Everything You Need to Know Refinancing a personal loan can be a smart financial move when done strategically. Whether you’re aiming to secure lower interest rates, reduce monthly payments, or consolidate debt, understanding the process and benefits of refinancing is crucial. This comprehensive guide will walk you through the essentials of refinancing personal loans, including tips, FAQs, …

Read More »

Jenifer Arley

November 29, 2024 Personal Loans

Early Loan Repayment:Your Savings and Financial Freedom Early loan repayment is a strategy that can help you save on interest, reduce debt faster, and achieve financial independence. However, it requires careful planning and understanding of potential benefits and pitfalls. This guide will explore everything you need to know about early loan repayment, including tips and FAQs to help you make …

Read More »

Jenifer Arley

November 29, 2024 Personal Loans

Loan Interest Discount: Maximize Your Savings Effectively Loan interest discounts can significantly reduce the overall cost of borrowing, making loans more affordable and manageable. Whether you’re looking for a personal loan, a mortgage, or an auto loan, understanding and utilizing interest discounts effectively can save you thousands over the loan’s lifespan. This article provides comprehensive insights on loan interest discounts, …

Read More »

Jenifer Arley

November 28, 2024 Personal Loans

Loan Repayment Assistance: Managing Your Debt Managing loan repayments can be overwhelming, especially if financial challenges arise. Loan repayment assistance programs provide a lifeline for borrowers, helping them manage or reduce their debt burdens. In this guide, we’ll explore what loan repayment assistance is, how to access it, and practical tips for optimizing its benefits. What Is Loan Repayment Assistance? …

Read More »

Gerbang Finance

Gerbang Finance