Jenifer Arley

January 30, 2025 Personal Loans

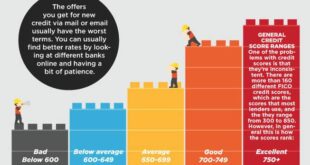

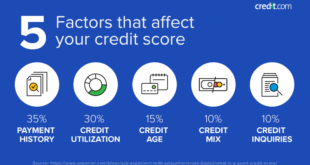

Financial Wellness and Credit Scores: Improving Financial Health Maintaining financial wellness is essential for achieving stability and security. One of the most critical aspects of financial wellness is understanding and managing your credit score. A strong credit score can unlock numerous financial opportunities, from securing loans with lower interest rates to improving your ability to rent a home. In this …

Read More »

Jenifer Arley

January 27, 2025 Credit Score

How Employers View Credit: Impact on Job Opportunities In today’s competitive job market, credit reports are playing an increasingly crucial role in hiring decisions. Employers view credit reports as a tool to evaluate a candidate’s financial responsibility, which can impact their eligibility for specific positions. In this article, we will delve into how employers view credit, why it’s important, and …

Read More »

Jenifer Arley

January 27, 2025 Credit Score

Average Credit Score by Age: Understanding Credit Trends Credit scores play a vital role in determining financial health. Understanding the average credit score by age helps individuals gauge their standing and take appropriate actions to improve or maintain their scores. In this article, we’ll explore average credit scores across age groups, factors influencing these trends, tips to boost scores, and …

Read More »

Jenifer Arley

January 27, 2025 Credit Score

Long-Term Credit Score Planning: Financial Health Maintaining a healthy credit score is essential for achieving financial stability and unlocking opportunities like affordable loans, lower interest rates, and better financial credibility. This article dives deep into long-term credit score planning, offering tips, strategies, and answers to frequently asked questions to guide you on your journey. Understanding the Basics of a Credit …

Read More »

Jenifer Arley

January 27, 2025 Credit Score

Rebuilding Credit After Bankruptcy: Starting Over Rebuilding credit after bankruptcy can feel daunting, but it’s an essential step toward regaining financial stability. While bankruptcy significantly impacts your credit score, it’s not the end of your financial journey. This guide will walk you through practical steps, strategies, and tips to rebuild your credit effectively and responsibly. Understanding the Impact of Bankruptcy …

Read More »

Jenifer Arley

January 25, 2025 Credit Score

Checking Family Credit Scores: Financial Well-being Maintaining a good credit score is crucial for financial stability, and this holds true for families as well. Checking family credit scores is a proactive step toward managing collective financial health. This guide provides actionable insights on how to monitor, improve, and manage family credit scores effectively. What Are Family Credit Scores? Family credit …

Read More »

Jenifer Arley

January 25, 2025 Credit Score

Removing Inquiries from Credit: Improve Your Credit Score When it comes to maintaining a healthy financial profile, understanding how to manage credit inquiries is essential. Hard inquiries can impact your credit score, and knowing how to address them effectively can save you from financial setbacks. This guide will walk you through everything you need to know about removing inquiries from …

Read More »

Jenifer Arley

January 25, 2025 Credit Score

Credit Score After Foreclosure: Understanding, Recovery Tips, FAQs Foreclosure is a challenging financial event that can significantly impact your credit score and overall financial health. Understanding how foreclosure affects your credit score and learning how to recover is crucial for rebuilding your financial stability. This article provides a comprehensive guide to navigating the aftermath of foreclosure, including actionable tips, frequently …

Read More »

Jenifer Arley

January 25, 2025 Credit Score

Building Credit After Divorce: Rebuilding Financial Stability Divorce can be emotionally and financially draining. One of the biggest challenges post-divorce is rebuilding your credit. Whether you shared accounts with your ex-spouse or are starting over financially, this guide will help you take control of your credit and lay a solid foundation for the future. Why Building Credit After Divorce Matters …

Read More »

Jenifer Arley

January 24, 2025 Credit Score

Improving Scores Without Credit Cards: A Comprehensive Guide Building and maintaining a good credit score is essential for financial stability. However, many people think it’s impossible to improve their scores without using credit cards. This article will explore effective strategies to improve your credit score without relying on credit cards, providing actionable tips and answering common questions about the process. …

Read More »

Jenifer Arley

January 24, 2025 Credit Score

Rent Payment Credit Score Boost: Improve Credit Score Rent Payments Improving your credit score is essential for better financial opportunities, and one lesser-known strategy is leveraging your rent payments. Rent payments can significantly boost your credit score when reported to credit bureaus. This article will explore how this process works, its benefits, and actionable tips to maximize its impact. What …

Read More »

Jenifer Arley

January 24, 2025 Credit Score

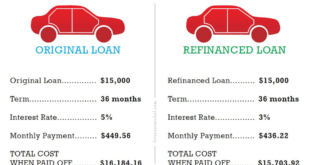

Low Credit Score Car Loans: Secure Financing Low Credit Rating Securing a car loan with a low credit score can seem challenging, but it’s not impossible. Many financial institutions offer specialized loans for individuals with less-than-perfect credit. This article explores the best strategies for obtaining a car loan with a low credit score, outlines essential tips for improving your chances, …

Read More »

Jenifer Arley

January 24, 2025 Credit Score

Credit Score Tips for Students: Building Maintaining Credit Score Building a strong credit score as a student may not seem like an immediate priority, but doing so can significantly impact your financial future. Whether you’re thinking about buying a car, applying for loans, or renting an apartment, your credit score will play a crucial role in the terms you’ll be …

Read More »

Jenifer Arley

January 23, 2025 Credit Score

Credit Score Impact Calculator: Credit Score Affects Financial Life A credit score is a numerical representation of your creditworthiness, based on your credit history and financial behavior. Lenders use this score to assess the risk of lending money to you, and it plays a crucial role in determining your loan terms, interest rates, and even job opportunities in some cases. …

Read More »

Jenifer Arley

January 23, 2025 Credit Score

Improving Poor Credit Quickly: Boost Your Credit Score If you’ve found yourself struggling with a poor credit score, you’re not alone. Many people face the challenge of rebuilding their credit, but the good news is that it’s possible to improve your credit quickly with the right strategies. In this article, we’ll cover effective ways to improve your credit score fast, …

Read More »

Gerbang Finance

Gerbang Finance