Jenifer Arley

February 3, 2025 Credit Score

Reassessing Credit Utilization Rates: Optimize Credit Score Credit utilization rate is one of the most critical factors in determining your credit score. Many individuals underestimate its impact on their overall financial health. Reassessing credit utilization rates can help you optimize your credit score, improve financial stability, and secure better loan opportunities. In this article, we will discuss what credit utilization …

Read More »

Jenifer Arley

February 3, 2025 Credit Score

Generating Better Credit Reports: Improving Your Credit Profile A well-structured credit report is essential for financial success. Whether you’re applying for loans, mortgages, or credit cards, a strong credit report increases your chances of approval and better interest rates. This article will provide expert tips and strategies to generate better credit reports and improve your overall financial standing. What is …

Read More »

Jenifer Arley

February 3, 2025 Credit Score

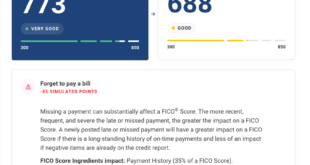

Advanced Credit Score Techniques: Boosting Your Credit Score A high credit score can unlock financial opportunities, from securing low-interest loans to getting premium credit cards. But improving your credit score isn’t just about paying bills on time—it requires advanced strategies. In this guide, we’ll explore Advanced Credit Score Techniques to help you optimize your financial health. 1. Understanding How Credit …

Read More »

Jenifer Arley

February 3, 2025 Credit Score

Low Credit Score Strategies: 10 Effective Ways Improve Credit Fast Having a low credit score can make it difficult to get approved for loans, credit cards, or even rental agreements. A poor credit score can also lead to higher interest rates, costing you more money in the long run. However, there are proven strategies to improve your credit score and …

Read More »

Jenifer Arley

February 1, 2025 Credit Score

International Credit Score Basics: Everything You Need to Know A good credit score is essential for financial freedom, especially if you plan to live, work, or study abroad. But did you know that credit scores differ from country to country? Understanding international credit scores can help you manage your finances effectively, whether you’re an expat, traveler, or international student. In …

Read More »

Jenifer Arley

February 1, 2025 Credit Score

Insurance and Credit Score: Affects Your Insurance Rates Many people are unaware that their credit score plays a crucial role in determining their insurance rates. Insurance companies use credit-based insurance scores to assess risk, which can significantly impact the cost of auto, home, and even life insurance. This article will explain how credit scores affect insurance, why insurers rely on …

Read More »

Jenifer Arley

February 1, 2025 Credit Score

Non-Traditional Credit Score Building: Improving Credit Without Credit Card Building a good credit score is essential for financial stability, but many people struggle because they don’t have access to traditional credit-building tools like credit cards or loans. Fortunately, non-traditional credit score building offers alternative ways to establish and improve your creditworthiness. In this guide, we’ll explore various non-traditional methods to …

Read More »

Jenifer Arley

February 1, 2025 Credit Score

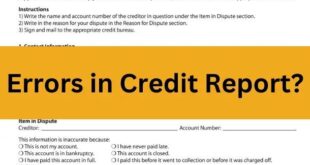

Fixing Incorrect Credit Reports: Step-by-Step Guide Correcting Errors Your credit report plays a crucial role in determining your financial health. Errors in your credit report can lead to denied loans, higher interest rates, and even missed job opportunities. If you’ve spotted inaccuracies in your credit history, it’s essential to take immediate action. This guide will help you understand how to …

Read More »

Jenifer Arley

January 31, 2025 Credit Score

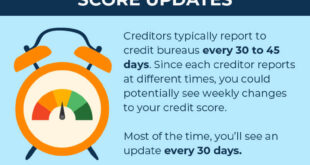

Regular Credit Report Checks: Financial Health In today’s fast-paced financial landscape, maintaining a good credit score is essential for achieving your financial goals. Regular credit report checks play a crucial role in this process, allowing individuals to monitor their credit health, detect errors, and prevent identity theft. In this article, we will explore the importance of credit report checks, how …

Read More »

Jenifer Arley

January 31, 2025 Credit Score

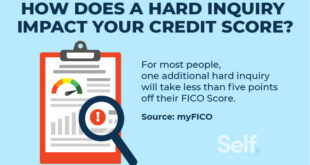

Impact of Hard Inquiries: How They Affect Your Credit Score In today’s financial landscape, understanding the intricacies of credit scoring is vital for anyone looking to make informed financial decisions. One significant aspect that often gets overlooked is the impact of hard inquiries on your credit report. This article delves into what hard inquiries are, their effects on your credit …

Read More »

Jenifer Arley

January 31, 2025 Credit Score

Generational Credit Score Trends: Different Generations Manage As financial landscapes evolve, understanding generational credit score trends becomes essential for individuals and financial institutions alike. Credit scores are not just numbers; they reflect how generations view credit, manage debt, and interact with financial systems. In this article, we will explore various credit score trends across generations, examining the factors influencing these …

Read More »

Jenifer Arley

January 31, 2025 Credit Score

Best Credit Score Habits: Financial Health Smart Credit Practices Maintaining a healthy credit score is crucial for financial stability and peace of mind. A good credit score can help you secure loans at favorable interest rates, rent apartments, and even get hired for certain jobs. However, bad credit habits can lead to financial difficulties and limit your options. In this …

Read More »

Jenifer Arley

January 30, 2025 Credit Score

Married Couples Credit Scores: Impact Financial Future Managing credit scores as a married couple is crucial for financial stability. Many couples assume that their credit scores automatically merge after marriage, but this is a misconception. Understanding how individual and joint credit scores work can help couples make informed financial decisions, avoid pitfalls, and improve their financial standing together. This article …

Read More »

Jenifer Arley

January 30, 2025 Credit Score

Military Credit Score Solutions: Improving Managing Credit Score Having a strong credit score is crucial for military personnel, whether they are active duty, veterans, or reservists. A good credit score can help secure better interest rates, lower insurance premiums, and improve financial stability. However, due to the unique challenges of military life—frequent relocations, deployments, and financial constraints—it can be difficult …

Read More »

Jenifer Arley

January 30, 2025 Credit Score

Travel Rewards Credit Scores: Improve and Maximize Benefits Travel rewards credit cards offer a fantastic way to earn points, miles, and cashback for your trips. However, your credit score plays a significant role in determining your eligibility for the best travel rewards credit cards. A higher credit score unlocks premium cards with better rewards, lower interest rates, and exclusive travel …

Read More »

Gerbang Finance

Gerbang Finance