Emergency Funds Loan: Quick Financial Relief When emergencies strike, having access to an emergency funds loan can be a lifesaver. This article delves deep into what emergency funds loans are, how they work, and tips to maximize their benefits. Whether you’re dealing with unexpected medical bills, urgent home repairs, or other unforeseen expenses, this guide will help you navigate your …

Read More »Personal Loans

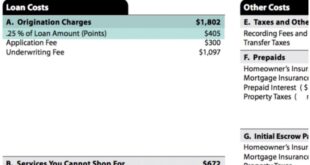

Loan Processing Fee: Everything You Need to Know

Loan Processing Fee: Everything You Need to Know Understanding the loan processing fee is essential for anyone considering a personal loan, home loan, or business loan. This fee is one of the many charges financial institutions impose, and it can significantly affect the total cost of borrowing. This comprehensive guide will explain what a loan processing fee is, how it …

Read More »Customizable Loan Terms: Flexible Financing

Customizable Loan Terms: Flexible Financing Customizable loan terms provide borrowers the flexibility to tailor loans to their specific needs, offering options to adjust repayment periods, interest rates, and payment schedules. This guide dives deep into the concept, benefits, tips for customization, and frequently asked questions to help you make informed decisions about flexible financing options. What Are Customizable Loan Terms? …

Read More »Unsecured Loan Options: Making the Right Choice

Unsecured Loan Options: Making the Right Choice When financial needs arise, and you lack collateral, unsecured loan options This guide covers everything you need to know about unsecured loans, including their types, benefits, drawbacks, and tips for making the best decision. What Are Unsecured Loans? Unsecured loans are loans that don’t require collateral, such as a car or home, to …

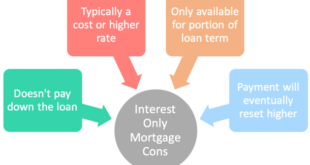

Read More »Interest-Only Loan: Everything You Need to Know

Interest-Only Loan: Everything You Need to Know An interest-only loan is a unique type of financing that allows borrowers to pay only the interest on the loan for a predetermined period, typically the first few years. These loans can be appealing for certain financial situations but come with distinct advantages and risks. Understanding the mechanics, benefits, and potential drawbacks is …

Read More »High-Risk Loan: Basics, Benefits, and Navigate Them

High-Risk Loan: Basics, Benefits, and Navigate Them High-risk loans can be a viable option for individuals or businesses that may not qualify for traditional financing. However, these loans come with their own challenges, including higher interest rates and stricter repayment terms. In this comprehensive guide, we will explore everything you need to know about high-risk loans, their advantages and drawbacks, …

Read More »No Cosigner Loan: Securing Loans Without a Cosigner

No Cosigner Loan: Securing Loans Without a Cosigner Finding a loan can be challenging, especially if you lack a cosigner to support your application. Thankfully, no cosigner loans offer a lifeline to those who prefer to handle their financial obligations independently. In this article, we’ll explore how no cosigner loans work, their benefits, eligibility requirements, and strategies to secure one. What Is …

Read More »Loan for Vacation: Finance Your Dream Getaway

Loan for Vacation: Finance Your Dream Getaway Planning a vacation is exciting, but funding your dream getaway can often feel daunting. A loan for vacation could be the perfect solution, offering you the flexibility to enjoy your trip without financial stress. In this guide, we’ll explore everything you need to know about vacation loans, including how they work, their pros …

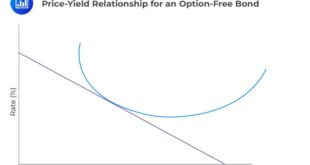

Read More »Fixed Interest Loan: Understanding and Leveraging Stability

Fixed Interest Loan: Understanding and Leveraging Stability Fixed interest loans provide borrowers with a reliable and predictable financial tool, offering consistent monthly payments and protection against fluctuating interest rates. Whether you’re considering a mortgage, auto loan, or personal loan, understanding the dynamics of fixed interest loans can help you make informed decisions. What is a Fixed Interest Loan? A fixed …

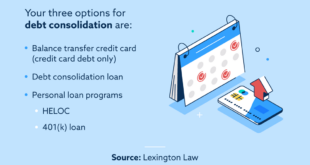

Read More »Loan Consolidation Options: Simplify Your Debt

Loan Consolidation Options: Simplify Your Debt Managing multiple debts can be overwhelming, especially with varying interest rates and payment schedules. Loan consolidation offers a practical solution to simplify your financial obligations. This guide explores loan consolidation options, their benefits, processes, and key tips for making the right choice. What is Loan Consolidation? Loan consolidation involves combining multiple loans into a single …

Read More » Gerbang Finance

Gerbang Finance