Personal Loan Fees: Understanding the Costs and Saving Money When considering a personal loan, one factor many borrowers overlook is the additional fees that can accompany it. Understanding personal loan fees is crucial because these costs can affect your total loan expense and impact the affordability of your loan. In this article, we will break down the types of fees …

Read More »Personal Loans

Secured Personal Loan: Benefits, Tips, and FAQs

Secured Personal Loan: Benefits, Tips, and FAQs Secured personal loans offer a financial solution for borrowers looking for favorable rates and higher loan amounts by leveraging collateral. Understanding the ins and outs of these loans can be beneficial for anyone looking to fund a significant purchase or consolidate debt. This guide will break down secured personal loans, covering benefits, steps …

Read More »Fixed Rate Loan: Understanding and Managing Fixed Interest Loans

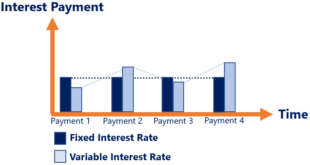

Fixed Rate Loan: Understanding and Managing Fixed Interest Loans Fixed-rate loans have become a popular choice among borrowers due to their stability and predictability. By locking in an interest rate, these loans provide a consistent monthly payment, making them an appealing option for those looking to budget effectively over the life of the loan. In this article, we will discuss …

Read More »Personal Loan Offers: Understanding, Choosing Benefits

Personal Loan Offers: Understanding, Choosing Benefits Personal loans can be a powerful financial tool for managing expenses, covering emergencies, or achieving your dreams. However, selecting the best personal loan offer requires knowledge of loan terms, interest rates, and lender options. This guide will help you navigate personal loan offers, understand key factors, and make an informed choice that suits your …

Read More »Loan Approval Process: Getting Your Loan Approved

Loan Approval Process: Getting Your Loan Approved The loan approval process can feel complex, especially if you’re new to it. In this guide, we’ll break down each stage of the process, offering insights into what lenders look for and tips on maximizing your chances for approval. This clear and detailed article will serve as your comprehensive resource on the loan …

Read More »Personal Loan Rates: Understanding and Choosing the Best Rates

Personal Loan Rates: Understanding and Choosing the Best Rates Personal loans are a popular way to access funds for various needs, from debt consolidation to unexpected expenses. However, one of the key factors to consider when selecting a personal loan is the interest rate. This guide will provide an in-depth look at personal loan rates, factors that influence them, how …

Read More »Instant Personal Loan: Getting Fast and Convenient Financing

Instant Personal Loan: Getting Fast and Convenient Financing In today’s fast-paced world, financial emergencies can happen to anyone at any time. This is where an instant personal loan becomes a lifesaver. Whether it’s to cover medical expenses, consolidate debt, or pay for unexpected repairs, instant personal loans provide quick access to cash without the lengthy approval process associated with traditional …

Read More »Investment Management Fees: Costs of Your Investment Strategy

Investment Management Fees: Understanding the Costs of Your Investment Strategy. In today’s investment landscape, understanding the costs associated with investment management is crucial for making informed financial decisions. Investment management fees can significantly impact your overall returns and can often be a source of confusion for investors. This comprehensive guide will help you navigate the complexities of investment management fees, explaining …

Read More »Reverse Mortgages Explained: A Guide for Homeowners

Reverse Mortgages Explained: A Guide for Homeowners. In today’s financial landscape, reverse mortgages have become a popular option for homeowners, especially those nearing or in retirement. They offer a way to unlock the value of your home without selling it, providing much-needed funds for everyday expenses, medical costs, or other financial goals. In this article, we’ll dive deep into reverse mortgages, …

Read More »Mortgage for Vacation Homes: A Guide to Financing Your Dream Getaway

Mortgage for Vacation Homes: A Guide to Financing Your Dream Getaway. Purchasing a vacation home is a dream for many, offering a place to escape from daily stress or an opportunity to earn passive income through short-term rentals. If you’re considering buying a vacation property, understanding the mortgage process is key to ensuring a smooth purchase. This guide will walk you …

Read More » Gerbang Finance

Gerbang Finance