Investment Property Loans: A Guide for Smart Investors. Investment property loans are a crucial aspect of real estate investing. They offer the financial leverage that investors need to purchase properties, whether for residential rentals or commercial purposes. However, these loans come with unique requirements and challenges that set them apart from typical home loans. In this guide, we’ll explore everything you …

Read More »Home Loans

Home Loan for Self-Employed: A Guide to Securing a Mortgage

Home Loan for Self-Employed: A Guide to Securing a Mortgage. Securing a home loan can be challenging for anyone, but it is often even more complex for self-employed individuals. Without the traditional forms of income verification that salaried workers can present, lenders may require more documentation and stricter qualifications from self-employed borrowers. This article will explore the process of obtaining a …

Read More »Home Loan with Bad Credit: How to Secure Financing Even with Low Credit Scores

Home Loan with Bad Credit: How to Secure Financing Even with Low Credit Scores. Getting a home loan with bad credit can seem daunting, but it’s far from impossible. Many people assume that a low credit score will automatically disqualify them from buying a house, but that’s not always the case. With careful planning, persistence, and knowledge of the right strategies, …

Read More »Mortgage Down Payment Assistance: A Guide

Mortgage Down Payment Assistance: A Guide. Homeownership is a dream for many, but the biggest hurdle often lies in saving enough for a down payment. Mortgage down payment assistance can be a lifeline for first-time buyers or those struggling to afford the upfront costs. This guide will explain what down payment assistance is, who qualifies for it, and how you can …

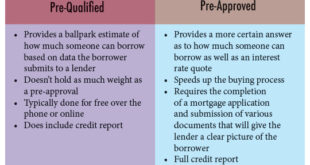

Read More »Mortgage Prequalification vs Preapproval: Understanding the Importance

Mortgage Prequalification vs Preapproval: Understanding the Importance. When you’re preparing to buy a home, it’s important to understand the key differences between mortgage prequalification and mortgage preapproval. Both terms are essential steps in the homebuying process, but they serve different purposes and offer varying levels of certainty to buyers and sellers. In this article, we will explore the details of mortgage …

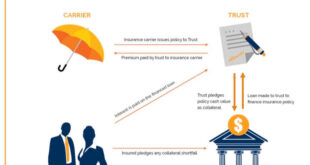

Read More »Mortgage Insurance Premium: Its Importance and How It Works

Mortgage Insurance Premium: Its Importance and How It Works. When considering a mortgage, many buyers are often surprised by additional costs that are not part of the principal and interest. One such cost is the Mortgage Insurance Premium (MIP). Understanding what a mortgage insurance premium is, how it works, and why it’s necessary can help homeowners make more informed decisions. …

Read More »Mortgage Points Explained: How They Work

Mortgage Points Explained: How They Work and How to Use Them Wisely. When considering buying a home, or even refinancing, understanding the concept of mortgage points can significantly affect how much you end up paying over time. Mortgage points, also known as discount points, allow you to lower your mortgage interest rate, resulting in long-term savings. But are they always worth …

Read More »No Credit Home Loans: A Guide to Securing Your Dream Home

No Credit Home Loans: A Guide to Securing Your Dream Home. In today’s financial landscape, obtaining a home loan can be challenging, especially for individuals with no credit history or poor credit scores. However, the emergence of no credit home loans offers a viable solution for many aspiring homeowners. This article will delve into what no credit home loans are, …

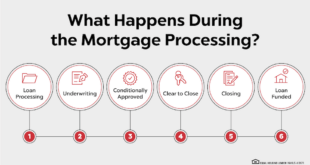

Read More »Home Loan Closing Costs: Everything You Need to Know

Home Loan Closing Costs: Everything You Need to Know. When purchasing a home, the home loan closing process can be both exciting and overwhelming. One of the essential parts of this process is the closing costs, which are fees and expenses you need to pay in addition to your home loan. Whether you are a first-time buyer or refinancing your mortgage, …

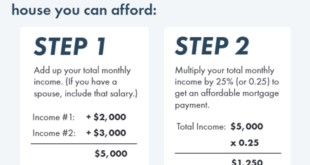

Read More »How to Qualify for a Mortgage: Your Guide to Homeownership

How to Qualify for a Mortgage: Your Guide to Homeownership. Qualifying for a mortgage is a crucial step in your journey toward homeownership. Whether you’re a first-time buyer or looking to refinance, understanding the requirements and process can make a significant difference. In this article, we’ll cover everything you need to know about how to qualify for a mortgage, from credit …

Read More » Gerbang Finance

Gerbang Finance