Home Insurance Coverage Options: Guide to Protecting Your Property. When you own a home, protecting your investment with home insurance is essential. Not only does it give you peace of mind, but it also safeguards your property from potential risks such as natural disasters, theft, and accidents. With numerous coverage options available, selecting the right plan can be overwhelming. In this …

Read More »Home Loans

Home Loan Approval Checklist: Your Guide to Securing Your Mortgage

Home Loan Approval Checklist: Your Guide to Securing Your Mortgage. In today’s competitive housing market, securing a home loan can be both an exciting and daunting task. To simplify the process, we’ve created a comprehensive home loan approval checklist to guide you through the necessary steps and requirements. This article will delve into the essential components of the home loan approval …

Read More »30-Year Fixed Mortgage vs. 15-Year: Which Is Right for You?

30-Year Fixed Mortgage vs. 15-Year: Which Is Right for You? When considering a home loan, one of the most significant decisions decisions you’ll make is choosing between a 30-year fixed mortgage and a 15-year fixed mortgage. Both options have distinct advantages and disadvantages that can impact your financial future. Understanding these differences can help you make an informed decision that aligns …

Read More »Home Loan for Teachers: A Guide to Financing Your Dream Home

Home Loan for Teachers: A Guide to Financing Your Dream Home. In today’s economic landscape, securing a home loan is crucial for many individuals, including teachers. With a stable job and a passion for education, teachers are often in a prime position to obtain favorable mortgage terms. This article will explore everything you need to know about home loans tailored for …

Read More »Mortgage for Second Homes: A Comprehensive Guide

Mortgage for Second Homes: A Comprehensive Guide. Purchasing a second home can be a rewarding investment, whether for vacation, rental income, or future retirement. However, securing a mortgage for a second home comes with its unique set of challenges and considerations. This guide explores the ins and outs of obtaining a mortgage for a second property, providing you with valuable insights …

Read More »Government Home Loan Programs: Your Pathway to Affordable Housing

Government Home Loan Programs: Your Pathway to Affordable Housing. Navigating the world of homeownership can often feel overwhelming, especially with the myriad of options available. However, government home loan programs serve as a beacon of hope for many potential homeowners. These initiatives, designed to make housing more accessible, provide favorable terms and conditions to help individuals and families secure their …

Read More »Mortgage Loan Fees Breakdown: Understanding the Costs Involved in Your Home Loan

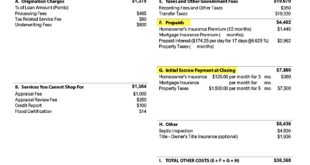

Mortgage Loan Fees Breakdown: Understanding the Costs Involved in Your Home Loan. When considering a mortgage loan, understanding the associated fees can be a daunting task. Many prospective homeowners focus solely on the interest rate, neglecting the various fees that can significantly impact the overall cost of borrowing. This comprehensive guide will break down mortgage loan fees, providing clarity on what …

Read More »Mortgage Affordability Calculator: Your Essential Tool for Home Buying

Mortgage Affordability Calculator: Your Essential Tool for Home Buying. When it comes to buying a home, understanding what you can afford is crucial. A mortgage affordability calculator is an invaluable tool that helps prospective homebuyers determine their purchasing power based on their financial situation. This article will guide you through the ins and outs of mortgage affordability calculators, providing comprehensive insights, …

Read More »Home Loan Debt-to-Income Ratio: Understanding Its Impact on Your Mortgage Application

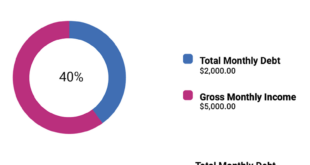

Home Loan Debt-to-Income Ratio: Understanding Its Impact on Your Mortgage Application. When it comes to securing a home loan, understanding the debt-to-income (DTI) ratio is essential. This critical financial metric helps lenders assess your ability to manage monthly payments and determines your eligibility for a mortgage. In this article, we will explore the home loan debt-to-income ratio in detail, providing insights …

Read More »VA Home Loan Benefits: Unlocking the Door to Homeownership for Veterans

VA Home Loan Benefits: Unlocking the Door to Homeownership for Veterans. For many veterans and active-duty military personnel, homeownership is not just a dream; it’s a well-deserved reality. The VA home loan program, established by the U.S. Department of Veterans Affairs (VA), offers unique benefits that make purchasing a home more accessible and affordable. This article will explore the various advantages …

Read More » Gerbang Finance

Gerbang Finance