Military Credit Score Solutions: Improving Managing Credit Score Having a strong credit score is crucial for military personnel, whether they are active duty, veterans, or reservists. A good credit score can help secure better interest rates, lower insurance premiums, and improve financial stability. However, due to the unique challenges of military life—frequent relocations, deployments, and financial constraints—it can be difficult …

Read More »Credit Score

Travel Rewards Credit Scores: Improve and Maximize Benefits

Travel Rewards Credit Scores: Improve and Maximize Benefits Travel rewards credit cards offer a fantastic way to earn points, miles, and cashback for your trips. However, your credit score plays a significant role in determining your eligibility for the best travel rewards credit cards. A higher credit score unlocks premium cards with better rewards, lower interest rates, and exclusive travel …

Read More »How Employers View Credit: Impact on Job Opportunities

How Employers View Credit: Impact on Job Opportunities In today’s competitive job market, credit reports are playing an increasingly crucial role in hiring decisions. Employers view credit reports as a tool to evaluate a candidate’s financial responsibility, which can impact their eligibility for specific positions. In this article, we will delve into how employers view credit, why it’s important, and …

Read More »Average Credit Score by Age: Understanding Credit Trends

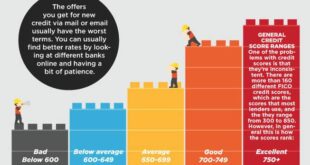

Average Credit Score by Age: Understanding Credit Trends Credit scores play a vital role in determining financial health. Understanding the average credit score by age helps individuals gauge their standing and take appropriate actions to improve or maintain their scores. In this article, we’ll explore average credit scores across age groups, factors influencing these trends, tips to boost scores, and …

Read More »Long-Term Credit Score Planning: Financial Health

Long-Term Credit Score Planning: Financial Health Maintaining a healthy credit score is essential for achieving financial stability and unlocking opportunities like affordable loans, lower interest rates, and better financial credibility. This article dives deep into long-term credit score planning, offering tips, strategies, and answers to frequently asked questions to guide you on your journey. Understanding the Basics of a Credit …

Read More »Rebuilding Credit After Bankruptcy: Starting Over

Rebuilding Credit After Bankruptcy: Starting Over Rebuilding credit after bankruptcy can feel daunting, but it’s an essential step toward regaining financial stability. While bankruptcy significantly impacts your credit score, it’s not the end of your financial journey. This guide will walk you through practical steps, strategies, and tips to rebuild your credit effectively and responsibly. Understanding the Impact of Bankruptcy …

Read More »Checking Family Credit Scores: Financial Well-being

Checking Family Credit Scores: Financial Well-being Maintaining a good credit score is crucial for financial stability, and this holds true for families as well. Checking family credit scores is a proactive step toward managing collective financial health. This guide provides actionable insights on how to monitor, improve, and manage family credit scores effectively. What Are Family Credit Scores? Family credit …

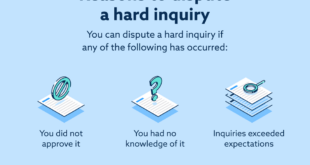

Read More »Removing Inquiries from Credit: Improve Your Credit Score

Removing Inquiries from Credit: Improve Your Credit Score When it comes to maintaining a healthy financial profile, understanding how to manage credit inquiries is essential. Hard inquiries can impact your credit score, and knowing how to address them effectively can save you from financial setbacks. This guide will walk you through everything you need to know about removing inquiries from …

Read More »Credit Score After Foreclosure: Understanding, Recovery Tips, FAQs

Credit Score After Foreclosure: Understanding, Recovery Tips, FAQs Foreclosure is a challenging financial event that can significantly impact your credit score and overall financial health. Understanding how foreclosure affects your credit score and learning how to recover is crucial for rebuilding your financial stability. This article provides a comprehensive guide to navigating the aftermath of foreclosure, including actionable tips, frequently …

Read More »Building Credit After Divorce: Rebuilding Financial Stability

Building Credit After Divorce: Rebuilding Financial Stability Divorce can be emotionally and financially draining. One of the biggest challenges post-divorce is rebuilding your credit. Whether you shared accounts with your ex-spouse or are starting over financially, this guide will help you take control of your credit and lay a solid foundation for the future. Why Building Credit After Divorce Matters …

Read More » Gerbang Finance

Gerbang Finance