Personal Injury Protection: Coverage, Benefits, and How It Works Personal Injury Protection (PIP) is an essential part of auto insurance that provides medical and financial benefits regardless of who is at fault in an accident. Many drivers are unaware of how PIP works, what it covers, and how it differs from other types of insurance like liability and health insurance. …

Read More »Auto Insurance

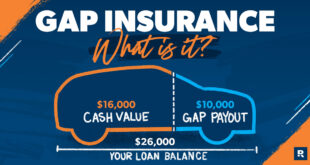

Gap Insurance Options: Coverage, Costs, and Best Choices

Gap Insurance Options: Coverage, Costs, and Best Choices When you buy a new or used car, standard auto insurance may not be enough to cover the full cost if your vehicle is totaled or stolen. This is where gap insurance comes into play. It helps cover the difference (or “gap”) between what you owe on your car loan or lease …

Read More »Roadside Assistance Coverage: Need to Know Before Need It

Roadside Assistance Coverage: Need to Know Before Need It Roadside assistance coverage is an essential service that provides drivers with emergency help when they experience vehicle breakdowns or unexpected issues on the road. Whether you’re dealing with a flat tire, a dead battery, or an empty gas tank, roadside assistance ensures that you’re not stranded in a dangerous or inconvenient …

Read More »Auto Rental Reimbursement: Everything You Need to Know

Auto Rental Reimbursement: Everything You Need to Know Auto rental reimbursement is an optional car insurance coverage that pays for the cost of a rental car while your insured vehicle is being repaired due to a covered claim. This coverage ensures you have transportation while your car is in the shop after an accident. Many insurance providers offer rental reimbursement …

Read More »Accident Forgiveness Policies: Work and Why You Need One

Accident Forgiveness Policies: Work and Why You Need One Car accidents can be stressful and expensive, especially when they lead to higher insurance rates. Fortunately, many insurance companies offer accident forgiveness policies to help protect drivers from premium increases after their first at-fault accident. In this guide, we will explore what accident forgiveness is, how it works, who qualifies, and …

Read More »Auto Claims Process: A Step-by-Step to Filing and Settling Claim

Auto Claims Process: A Step-by-Step to Filing and Settling Claim When an accident happens, dealing with an auto insurance claim can feel overwhelming. Understanding the auto claims process is crucial to ensure a smooth and hassle-free experience. This guide will walk you through every step of the process, from filing a claim to receiving your payout. Understanding the Auto Claims …

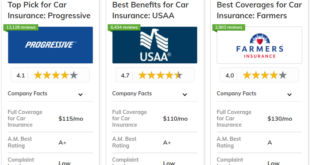

Read More »Online Insurance Quotes: Getting the Best Deals

Online Insurance Quotes: Getting the Best Deals In today’s digital age, getting online insurance quotes has become the easiest and most efficient way to compare policies, find the best rates, and secure financial protection. Whether you’re looking for auto, home, health, or life insurance, online quotes allow you to make informed decisions without the hassle of visiting multiple insurance offices. …

Read More »Auto Insurance Brokers: Find the Best One for Needs

Auto Insurance Brokers: Find the Best One for Needs Auto insurance is essential for every car owner, but navigating the vast number of insurance providers can be overwhelming. This is where auto insurance brokers come in. They act as intermediaries between insurance companies and customers, helping you find the best coverage at the best price. In this guide, we’ll explore …

Read More »Temporary Auto Coverage: Everything You Need to Know

Temporary Auto Coverage: Everything You Need to Know When you purchase a car or rent one for a short period, you might not always have immediate insurance coverage. This is where temporary auto coverage comes into play. This type of short-term car insurance offers flexibility and protection without long-term commitments. Whether you need coverage for a few days, weeks, or …

Read More »High-Risk Auto Insurance: Need to Know and How to Save Money

High-Risk Auto Insurance: Need to Know and How to Save Money High-risk auto insurance is a necessity for drivers with a history of traffic violations, accidents, or other factors that make insurers consider them risky. If you’ve been classified as a high-risk driver, you may face higher premiums and fewer policy options. However, there are ways to reduce costs and …

Read More » Gerbang Finance

Gerbang Finance