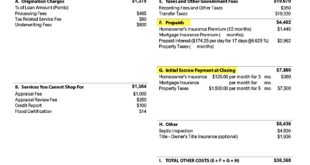

Mortgage Loan Fees Breakdown: Understanding the Costs Involved in Your Home Loan. When considering a mortgage loan, understanding the associated fees can be a daunting task. Many prospective homeowners focus solely on the interest rate, neglecting the various fees that can significantly impact the overall cost of borrowing. This comprehensive guide will break down mortgage loan fees, providing clarity on what …

Read More »maston

Mortgage Affordability Calculator: Your Essential Tool for Home Buying

Mortgage Affordability Calculator: Your Essential Tool for Home Buying. When it comes to buying a home, understanding what you can afford is crucial. A mortgage affordability calculator is an invaluable tool that helps prospective homebuyers determine their purchasing power based on their financial situation. This article will guide you through the ins and outs of mortgage affordability calculators, providing comprehensive insights, …

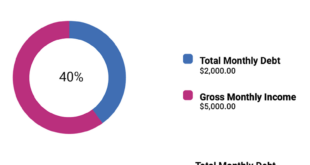

Read More »Home Loan Debt-to-Income Ratio: Understanding Its Impact on Your Mortgage Application

Home Loan Debt-to-Income Ratio: Understanding Its Impact on Your Mortgage Application. When it comes to securing a home loan, understanding the debt-to-income (DTI) ratio is essential. This critical financial metric helps lenders assess your ability to manage monthly payments and determines your eligibility for a mortgage. In this article, we will explore the home loan debt-to-income ratio in detail, providing insights …

Read More »VA Home Loan Benefits: Unlocking the Door to Homeownership for Veterans

VA Home Loan Benefits: Unlocking the Door to Homeownership for Veterans. For many veterans and active-duty military personnel, homeownership is not just a dream; it’s a well-deserved reality. The VA home loan program, established by the U.S. Department of Veterans Affairs (VA), offers unique benefits that make purchasing a home more accessible and affordable. This article will explore the various advantages …

Read More »FHA vs. Conventional Home Loans: Understanding Your Home Financing

FHA vs. Conventional Home Loans: Understanding Your Options for Home Financing. When it comes to buying a home, securing the right financing is crucial. Among the most popular choices are FHA (Federal Housing Administration) loans and conventional home loans. Each option has its unique features, benefits, and drawbacks, making it essential to understand how they differ. In this comprehensive article, we …

Read More »Mortgage Rates Forecast: What You Need to Know in 2024

Mortgage Rates Forecast: What You Need to Know in 2024. As we step into 2024, the landscape of mortgage rates is poised for significant changes. For potential homebuyers and homeowners looking to refinance, understanding the forecast for mortgage rates is crucial for making informed financial decisions. This article will delve into the factors influencing mortgage rates, predictions for 2024, and …

Read More »How to Pay Off Mortgage Early: 10 Tips to Save Time and Money

How to Pay Off Mortgage Early: 10 Tips to Save Time and Money. Paying off a mortgage early is a goal for many homeowners. It not only helps save on interest payments but also provides peace of mind and financial freedom. While paying off your mortgage faster might seem challenging, there are several strategies to help you achieve this goal more …

Read More »Best Mortgage Lenders in USA: Top Picks for 2024

Best Mortgage Lenders in USA: Top Picks for 2024. When it comes to buying a home, choosing the right mortgage lender is one of the most critical decisions you’ll make. Finding a lender that offers competitive rates, exceptional service, and favorable terms can save you thousands over the life of your loan. Whether you’re a first-time homebuyer or looking to refinance, …

Read More »Mortgage with No Closing Costs: A Comprehensive Guide

Mortgage with No Closing Costs: A Comprehensive Guide. If you’re considering buying a home or refinancing your current mortgage, you’ve probably come across the term “mortgage with no closing costs.” While the idea of eliminating upfront fees sounds appealing, it’s important to understand how these mortgages work, their advantages, disadvantages, and whether they are the right choice for you. What is …

Read More »How to Refinance a Mortgage: A Guide

How to Refinance a Mortgage: A Guide. Refinancing a mortgage can be an effective strategy for homeowners looking to lower their interest rates, reduce monthly payments, or pay off their home loans faster. However, the process can seem overwhelming if you don’t know where to start. In this guide, we’ll break down everything you need to know about how to refinance …

Read More » Gerbang Finance

Gerbang Finance