Home Loan for Military: Best Options, Benefits, and How to Apply Home loans for military personnel provide unique benefits that make homeownership more accessible and affordable. Whether you are an active-duty service member, veteran, or part of the National Guard or Reserves, there are several mortgage programs tailored to your needs. Understanding your options can help you secure the best …

Read More »Jenifer Arley

Home Loan for Doctors: Exclusive Mortgage Benefits

Home Loan for Doctors: Exclusive Mortgage Benefits Doctors have unique financial profiles that set them apart from other professionals. With high earning potential, substantial student loan debt, and the stability of their career, banks and financial institutions offer exclusive mortgage programs tailored to their needs. This guide explores the benefits, eligibility, application process, and key considerations for doctors seeking a …

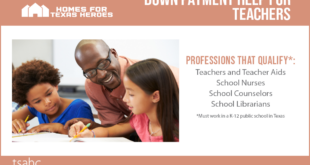

Read More »Home Loan for Teachers: Affordable Financing

Home Loan for Teachers: Affordable Financing Buying a home is a major milestone, but for teachers, navigating the mortgage process can be challenging. With fluctuating salaries, student loan debt, and high housing costs, finding an affordable home loan is crucial. Fortunately, there are specialized home loan programs designed specifically for educators, offering lower interest rates, reduced down payments, and flexible …

Read More »Home Loan for Students: Affordable Financing

Home Loan for Students: Affordable Financing Owning a home while studying may sound impossible, but with the right home loan for students, it can be a reality. Many financial institutions offer student-friendly mortgage options, making it easier to invest in property even before you graduate. This guide covers everything you need to know about home loans for students, from eligibility …

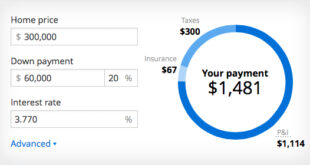

Read More »Calculate Home Loan Payments: Planning Your Mortgage

Calculate Home Loan Payments: Planning Your Mortgage Buying a home is a significant financial commitment, and understanding how to calculate home loan payments is crucial for effective budgeting. Whether you are a first-time homebuyer or refinancing your mortgage, knowing your monthly payments helps you plan ahead and avoid financial strain. This article provides a detailed step-by-step guide on how to …

Read More »Home Loan for Apartment: Financing Your Dream Home

Home Loan for Apartment: Financing Your Dream Home Buying an apartment is a major financial decision, and securing the right home loan for an apartment can make all the difference. Whether you’re a first-time homebuyer or an investor, understanding the loan process, interest rates, and eligibility criteria is crucial. This guide will walk you through everything you need to know …

Read More »Home Loan for Condo: Financing Your Dream Apartment

Home Loan for Condo: Financing Your Dream Apartment Buying a condominium is an exciting step toward homeownership, but securing the right home loan for a condo can be challenging. Condos have unique financing requirements compared to single-family homes, making it essential to understand loan options, eligibility criteria, and financial considerations before applying. This article provides a comprehensive guide to home …

Read More »Home Loan Approval Guide: Getting Approved Fast

Home Loan Approval Guide: Getting Approved Fast Applying for a home loan can be a daunting process, especially if you’re a first-time homebuyer. Understanding the steps involved and what lenders look for can significantly increase your chances of approval. This guide will walk you through the entire process, from checking your credit score to closing the deal, ensuring you get …

Read More »Home Loan Repayment Options: Pay Off Mortgage Faster

Home Loan Repayment Options: Pay Off Mortgage Faster Owning a home is a dream for many, but managing mortgage payments can sometimes feel overwhelming. Fortunately, there are multiple home loan repayment options available to make the process smoother and potentially save you thousands of dollars in interest. In this comprehensive guide, we’ll explore different repayment strategies, tips to pay off …

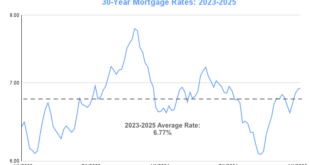

Read More »Best Home Loan Rates: Lowest Mortgage Rates in 2025

Best Home Loan Rates: Lowest Mortgage Rates in 2025 Buying a home is one of the biggest financial decisions you’ll ever make, and finding the best home loan rates is crucial to saving money over the long term. Mortgage rates can vary based on multiple factors, including your credit score, loan term, and the lender you choose. In this guide, …

Read More » Gerbang Finance

Gerbang Finance