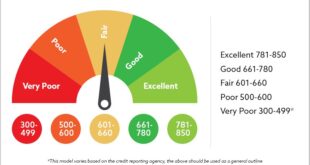

Improve Credit Before Buying: Financial Readiness Your credit score plays a pivotal role in determining whether you’re ready to make major purchases, such as buying a car or a home. In this article, we’ll explore effective strategies to improve your credit before making a purchase. Following these steps can help you save money, secure better interest rates, and achieve financial …

Read More »Jenifer Arley

How to Fix Credit Mistakes: A Comprehensive Guide

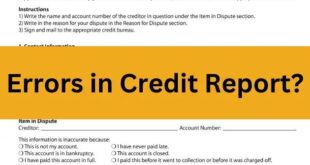

How to Fix Credit Mistakes: A Comprehensive Guide Having errors on your credit report can negatively impact your financial health. Credit mistakes may result in higher interest rates, difficulty securing loans, or even missed opportunities. Fortunately, fixing credit report errors is a process you can handle with patience and persistence. This article will guide you step-by-step on how to fix …

Read More »Credit Score for Renting Homes: Everything You Need to Know

Credit Score for Renting Homes: Everything You Need to Know When searching for a rental home, your credit score can play a critical role in securing your dream property. Many landlords and property managers rely on credit scores to assess a tenant’s financial responsibility. This article delves deep into the topic to help you understand how credit scores impact renting, …

Read More »Checking Partner Credit Scores: What You Need to Know

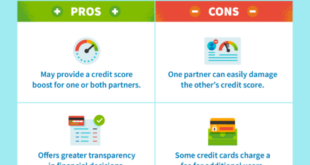

Checking Partner Credit Scores: What You Need to Know In today’s interconnected world, financial compatibility plays a critical role in maintaining a healthy relationship. Understanding your partner’s credit score can provide valuable insight into their financial habits, stability, and future planning. In this article, we’ll guide you through everything you need to know about checking your partner’s credit score and …

Read More »Credit Score Reporting Errors: Identify, Dispute, Protect Your Credit

Credit Score Reporting Errors: Identify, Dispute, and Protect Your Credit Your credit score is a crucial component of your financial health. However, credit score reporting errors can harm your ability to secure loans, credit cards, or even rental agreements. In this article, we’ll dive into what credit score reporting errors are, how they occur, and actionable steps to resolve and …

Read More »High Credit Score Benefits: Unlocking Financial Freedom

High Credit Score Benefits: Unlocking Financial Freedom Having a high credit score opens doors to numerous financial opportunities and benefits. Whether you’re aiming to secure a loan, purchase a home, or enjoy lower interest rates, your credit score plays a pivotal role. In this comprehensive article, we’ll explore the numerous benefits of a high credit score, practical tips to maintain …

Read More »Credit Score Repair Companies: Better Financial Health

Credit Score Repair Companies: Better Financial Health In today’s world, a good credit score is crucial for securing loans, better interest rates, and even rental agreements. If you’re struggling with your credit score, credit score repair companies can be an essential tool to help you regain control. This article will guide you through what these companies do, how to choose …

Read More »Secured Loans and Credit Scores: Everything You Need to Know

Secured Loans and Credit Scores: Everything You Need to Know Secured loans and credit scores are two intertwined concepts that play a significant role in personal finance. Understanding how these two elements interact can empower you to make informed financial decisions, improve your creditworthiness, and secure better loan terms. What Are Secured Loans? Secured loans are a type of borrowing …

Read More »Credit Utilization Impact: Shapes Your Financial Health

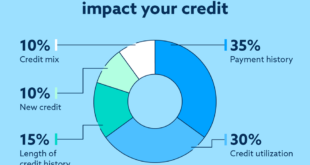

Credit Utilization Impact: Shapes Your Financial Health Managing credit wisely is essential to maintaining a healthy financial profile, and understanding the concept of credit utilization plays a key role in this process. This comprehensive guide explores the impact of credit utilization on your credit score, financial well-being, and borrowing potential. What Is Credit Utilization? Credit utilization refers to the percentage …

Read More »Credit Score vs Credit History: Key Differences and Their Impact

Credit Score vs Credit History: Key Differences and Their Impact Your Finances In personal finance, terms like “credit score” and “credit history” are often used interchangeably, but they represent distinct concepts. Understanding the difference is crucial for managing your financial health effectively. This article explores the nuances of credit scores and credit history, their importance, and how they influence your …

Read More » Gerbang Finance

Gerbang Finance