Rent Payment Credit Score Boost: Improve Credit Score Rent Payments Improving your credit score is essential for better financial opportunities, and one lesser-known strategy is leveraging your rent payments. Rent payments can significantly boost your credit score when reported to credit bureaus. This article will explore how this process works, its benefits, and actionable tips to maximize its impact. What …

Read More »Jenifer Arley

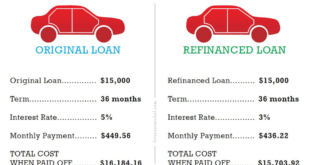

Low Credit Score Car Loans: Secure Financing Low Credit Rating

Low Credit Score Car Loans: Secure Financing Low Credit Rating Securing a car loan with a low credit score can seem challenging, but it’s not impossible. Many financial institutions offer specialized loans for individuals with less-than-perfect credit. This article explores the best strategies for obtaining a car loan with a low credit score, outlines essential tips for improving your chances, …

Read More »Credit Score Tips for Students: Building Maintaining Credit Score

Credit Score Tips for Students: Building Maintaining Credit Score Building a strong credit score as a student may not seem like an immediate priority, but doing so can significantly impact your financial future. Whether you’re thinking about buying a car, applying for loans, or renting an apartment, your credit score will play a crucial role in the terms you’ll be …

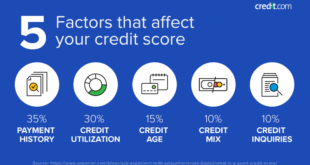

Read More »Credit Score Impact Calculator: Credit Score Affects Financial Life

Credit Score Impact Calculator: Credit Score Affects Financial Life A credit score is a numerical representation of your creditworthiness, based on your credit history and financial behavior. Lenders use this score to assess the risk of lending money to you, and it plays a crucial role in determining your loan terms, interest rates, and even job opportunities in some cases. …

Read More »Improving Poor Credit Quickly: Boost Your Credit Score

Improving Poor Credit Quickly: Boost Your Credit Score If you’ve found yourself struggling with a poor credit score, you’re not alone. Many people face the challenge of rebuilding their credit, but the good news is that it’s possible to improve your credit quickly with the right strategies. In this article, we’ll cover effective ways to improve your credit score fast, …

Read More »Minimum Credit Score Credit Cards: Choosing the Right Card

Minimum Credit Score Credit Cards: Choosing the Right Card In today’s financial landscape, understanding your credit score and how it affects your eligibility for various credit cards is crucial. Credit cards that cater to individuals with specific credit scores can help you rebuild credit, earn rewards, or manage finances better. This guide delves into the world of minimum credit score …

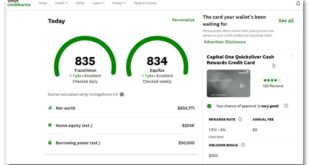

Read More »Credit Score Optimization Apps: Improve Financial Health Easily

Credit Score Optimization Apps: Improve Financial Health Easily Maintaining a good credit score is essential for anyone looking to secure loans, get approved for a credit card, or enjoy better interest rates. Fortunately, credit score optimization apps are here to simplify the process. These apps empower users to monitor, manage, and improve their credit scores conveniently. In this article, we’ll …

Read More »Highest Possible Credit Score: How to Achieve and Maintain It

Highest Possible Credit Score: How to Achieve and Maintain It Having the highest possible credit score can open doors to the best financial opportunities, from low-interest loans to premium credit card offers. This article provides a detailed roadmap to help you achieve and maintain a top-tier credit score, offering insights into how credit scores are calculated and the steps you …

Read More »Fraudulent Activity Credit Effects: Impact and Prevention Strategies

Fraudulent Activity Credit Effects: Impact and Prevention Strategies Fraudulent activities can wreak havoc on your credit score and financial stability. These deceptive actions not only affect your current credit but can also lead to long-term financial repercussions. This article delves into how fraudulent activities impact your credit, the warning signs to watch for, and effective strategies to safeguard yourself from …

Read More »Bankruptcy Credit Score Recovery: Regain Financial Stability

Bankruptcy Credit Score Recovery: Regain Financial Stability Filing for bankruptcy can be a challenging and emotional decision, but it doesn’t have to define your financial future. While bankruptcy impacts your credit score significantly, it is possible to recover and rebuild over time with the right steps. This article will provide you with a detailed guide to navigate the journey of …

Read More » Gerbang Finance

Gerbang Finance