Online Credit Repair Guides: Step-by-Step Fix Your Credit Score Maintaining a good credit score is crucial for financial stability. If your credit score is low, don’t worry—you can fix it with the right strategies. This Online Credit Repair Guide will walk you through everything you need to know about repairing your credit, from understanding your credit report to disputing errors …

Read More »Jenifer Arley

Poor Credit Score Loans: Approved and Improve Financial Future

Poor Credit Score Loans: Approved and Improve Financial Future Having a poor credit score can make it difficult to get a loan, but it’s not impossible. Many lenders offer loans specifically designed for borrowers with bad credit. These loans can help you cover urgent expenses, consolidate debt, or even rebuild your credit. In this guide, we’ll explore how to get …

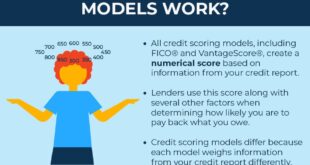

Read More »Comparing Credit Scoring Models: Differences Choosing Best One

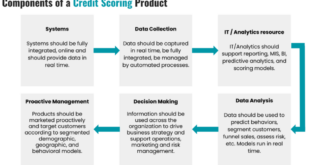

Comparing Credit Scoring Models: Differences Choosing Best One Credit scores play a vital role in financial decisions, affecting loan approvals, interest rates, and even job opportunities. However, not all credit scoring models are the same. Different models use unique algorithms, data sources, and scoring ranges, leading to variations in credit scores across different platforms. In this article, we will compare …

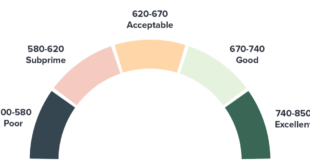

Read More »Loan Approvals by Score: Affects Loan Approval and Interest Rates

Loan Approvals by Score: Affects Loan Approval and Interest Rates Getting a loan approved often depends on various factors, but one of the most critical is your credit score. Lenders use credit scores to determine how reliable you are as a borrower and whether they should approve your loan application. In this article, we will explore how different credit scores …

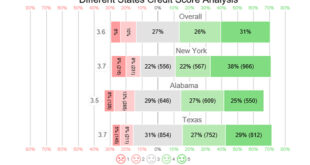

Read More »Predicting Credit Score Fluctuations: Credit Score Changes

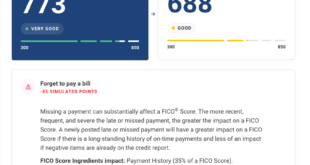

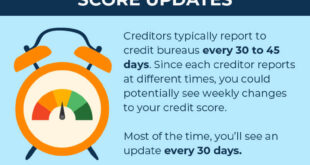

Predicting Credit Score Fluctuations: Credit Score Changes A credit score is a crucial factor in determining financial health. It influences loan approvals, interest rates, and even rental applications. However, credit scores do not remain static—they fluctuate based on various financial behaviors. Predicting credit score fluctuations can help individuals maintain a healthy score and make informed financial decisions. This article explores …

Read More »Reassessing Credit Utilization Rates: Optimize Credit Score

Reassessing Credit Utilization Rates: Optimize Credit Score Credit utilization rate is one of the most critical factors in determining your credit score. Many individuals underestimate its impact on their overall financial health. Reassessing credit utilization rates can help you optimize your credit score, improve financial stability, and secure better loan opportunities. In this article, we will discuss what credit utilization …

Read More »Generating Better Credit Reports: Improving Your Credit Profile

Generating Better Credit Reports: Improving Your Credit Profile A well-structured credit report is essential for financial success. Whether you’re applying for loans, mortgages, or credit cards, a strong credit report increases your chances of approval and better interest rates. This article will provide expert tips and strategies to generate better credit reports and improve your overall financial standing. What is …

Read More »Advanced Credit Score Techniques: Boosting Your Credit Score

Advanced Credit Score Techniques: Boosting Your Credit Score A high credit score can unlock financial opportunities, from securing low-interest loans to getting premium credit cards. But improving your credit score isn’t just about paying bills on time—it requires advanced strategies. In this guide, we’ll explore Advanced Credit Score Techniques to help you optimize your financial health. 1. Understanding How Credit …

Read More »Low Credit Score Strategies: 10 Effective Ways Improve Credit Fast

Low Credit Score Strategies: 10 Effective Ways Improve Credit Fast Having a low credit score can make it difficult to get approved for loans, credit cards, or even rental agreements. A poor credit score can also lead to higher interest rates, costing you more money in the long run. However, there are proven strategies to improve your credit score and …

Read More »International Credit Score Basics: Everything You Need to Know

International Credit Score Basics: Everything You Need to Know A good credit score is essential for financial freedom, especially if you plan to live, work, or study abroad. But did you know that credit scores differ from country to country? Understanding international credit scores can help you manage your finances effectively, whether you’re an expat, traveler, or international student. In …

Read More » Gerbang Finance

Gerbang Finance