Best Home Loan Deals: Perfect Mortgage for Your Needs Buying a home is one of the biggest financial decisions in life, and securing the best home loan deal can save you thousands of dollars in the long run. However, with so many lenders and loan options available, finding the right mortgage can be overwhelming. This guide will help you understand the key factors to consider, tips for getting the lowest interest rates, and common FAQs about home loans.

What Are Home Loan Deals?

Home loan deals refer to the mortgage packages offered by banks, credit unions, and lenders. These deals vary based on interest rates, loan terms, down payments, and fees. Choosing the right home loan depends on factors such as your credit score, income, and long-term financial goals.

Types of Home Loans

1. Fixed-Rate Home Loans

A fixed-rate mortgage has a set interest rate for a specific period, usually 15, 20, or 30 years. This type of loan is ideal for buyers who prefer predictable monthly payments.

2. Variable-Rate Home Loans

Also known as adjustable-rate mortgages (ARMs), these loans have interest rates that fluctuate based on market conditions. While they often start with lower rates, they can increase over time.

3. FHA Loans

Federal Housing Administration (FHA) loans are government-backed mortgages designed for first-time buyers with lower credit scores and smaller down payments.

4. VA Loans

Veterans Affairs (VA) loans are exclusive to military personnel and veterans. They offer competitive interest rates, no down payment, and reduced closing costs.

5. Jumbo Loans

Jumbo loans are for home purchases that exceed the loan limits set by Fannie Mae and Freddie Mac. These loans typically require higher credit scores and larger down payments.

6. Interest-Only Loans

With an interest-only mortgage, borrowers pay only the interest for a specific period, after which principal payments begin. This option is riskier but can provide flexibility for certain buyers.

How to Find the Best Home Loan Deals

1. Compare Multiple Lenders

Different lenders offer varying interest rates, terms, and fees. Use online mortgage comparison tools to evaluate your options.

2. Check Your Credit Score

A high credit score helps you qualify for lower interest rates. Before applying for a mortgage, check your credit report and correct any errors.

3. Negotiate Loan Terms

Lenders may offer discounts or better rates if you negotiate. Don’t hesitate to ask about promotions or fee waivers.

4. Consider Loan Term Length

Shorter loan terms (e.g., 15 years) usually have lower interest rates but higher monthly payments. A longer term (e.g., 30 years) reduces monthly costs but increases total interest paid.

5. Understand All Fees

Look beyond interest rates. Some loans come with hidden fees such as origination charges, closing costs, and prepayment penalties.

6. Get Pre-Approved

A mortgage pre-approval strengthens your position as a buyer and helps you determine how much you can afford.

7. Choose Between Fixed and Variable Rates

Fixed rates provide stability, while variable rates may offer lower initial payments. Consider your financial goals before deciding.

8. Look for Government-Backed Loans

FHA, VA, and USDA loans often have better terms and lower down payment requirements.

9. Improve Your Debt-to-Income Ratio

Lenders prefer borrowers with a lower debt-to-income (DTI) ratio. Paying down existing debt can improve your chances of approval.

10. Lock in Your Interest Rate

Interest rates fluctuate daily. If you find a good rate, consider locking it in to avoid future increases.

10 Tips to Get the Best Home Loan Deals

- Maintain a credit score of 700+ for better rates.

- Save at least a 20% down payment to avoid private mortgage insurance (PMI).

- Compare at least three lenders before making a decision.

- Avoid making major purchases before applying for a mortgage.

- Pay down credit card debt to lower your DTI ratio.

- Choose a shorter loan term if you can afford higher payments.

- Use a mortgage broker to access exclusive deals.

- Consider refinancing if interest rates drop significantly.

- Ask about lender incentives or first-time homebuyer programs.

- Ensure the loan fits your long-term financial plans.

10 Frequently Asked Questions (FAQs)

1. What is the best home loan type for first-time buyers?

FHA loans are great for first-time buyers due to low down payments and flexible credit requirements.

2. How does my credit score affect my mortgage rate?

Higher credit scores qualify for lower interest rates, saving you money over time.

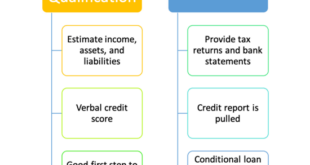

3. What is the difference between pre-qualification and pre-approval?

Pre-qualification is an estimate of how much you can borrow, while pre-approval is a lender’s official confirmation.

4. Are online mortgage lenders reliable?

Yes, but always check reviews, licensing, and terms before choosing an online lender.

5. Can I get a home loan with bad credit?

Yes, FHA and subprime loans cater to borrowers with lower credit scores.

6. What is a loan origination fee?

It’s a charge by lenders for processing your mortgage, typically 0.5%–1% of the loan amount.

7. How do I lower my mortgage interest rate?

Improve your credit score, shop around for lenders, and consider buying discount points.

8. Is a fixed or variable rate mortgage better?

Fixed rates provide stability, while variable rates may be cheaper initially but can increase later.

9. How much should I save for a down payment?

Most lenders require 3%–20%, but some government-backed loans offer 0% down options.

10. What happens if I miss a mortgage payment?

Missing a payment can hurt your credit score and lead to penalties. Contact your lender if you face financial difficulties.

Conclusion

Finding the best home loan deals requires research, comparison, and financial preparation. By improving your credit score, comparing lenders, and understanding loan terms, you can secure a mortgage that fits your needs. Whether you’re a first-time buyer or refinancing an existing loan, making informed decisions will save you money and stress in the long run.

Homeownership is a major milestone, and the right mortgage can make it a more affordable and rewarding experience. Take the time to evaluate your options, use available resources, and seek professional advice if needed. The effort you put in now will pay off with a better financial future.

Gerbang Finance

Gerbang Finance